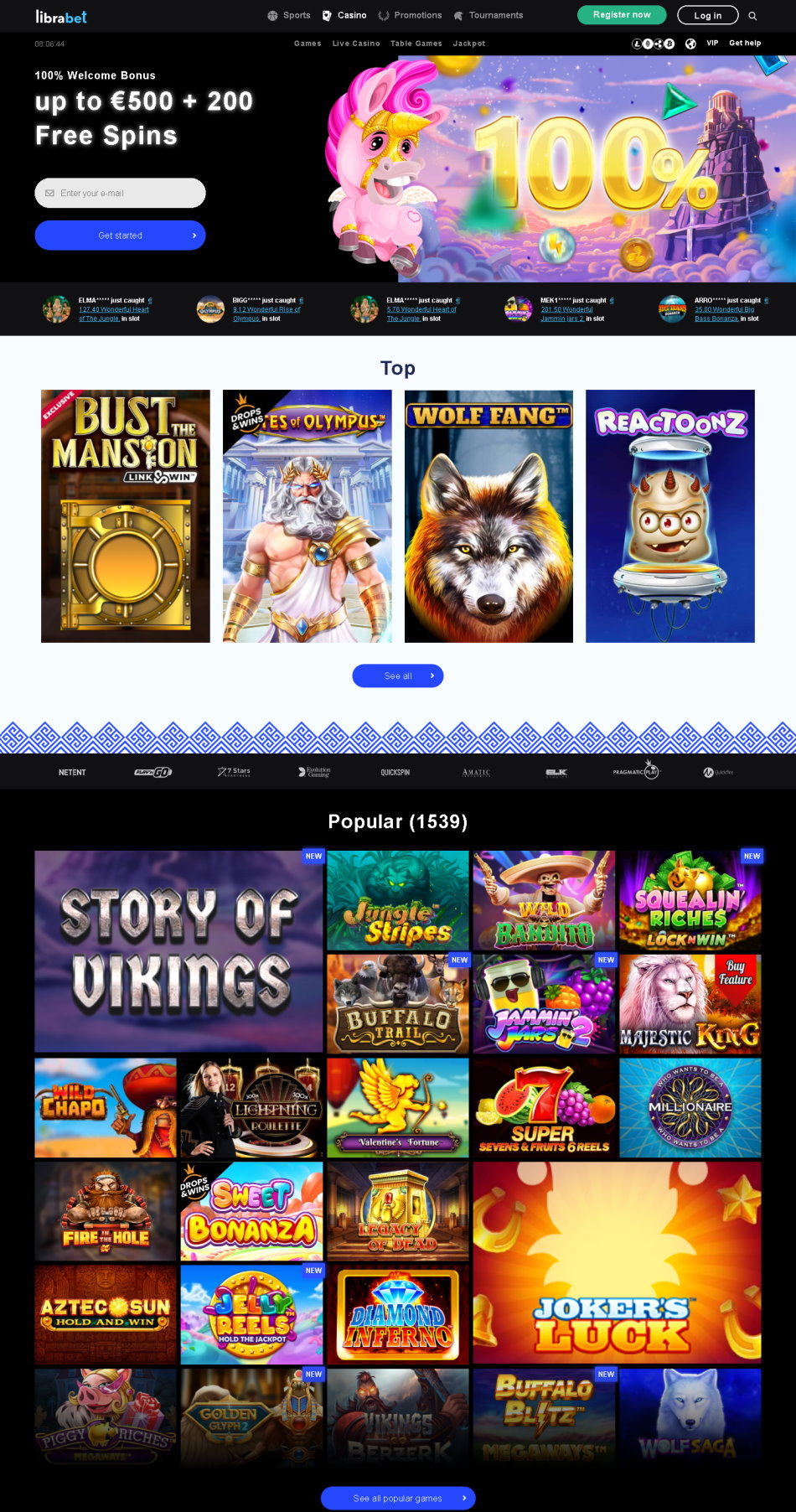

LibraBet Casino has tons of games to choose from and offers attractive promotions and bonuses that can be rarely seen anywhere else in the industry. This casino is packed with a huge collection of games, with more than 1,000 of them available to play.

LibraBet Casino is a colorful online casino with a very rich gaming library set to fit every gaming taste out there. The casino offers its customers a large selection of games, many bonus offers, a very accessible support and the most important payment methods.

LibraBet Casino is without a doubt a great choice for players who want a rewarding casino gaming experience. The casino has designed many promotions with the intention of entertaining players and giving them an incentive to play.

In order for quantity and quality to go hand in hand, LibraBet Casino has to establish cooperation with many software partners. Players who choose the casino enjoy games from renown casino software developers like Yggdrasil, Rival, Red Rake, NetEnt, Microgaming, Pragmatic Play, QuickSpin, GameArt, Push Gaming, EGT. The casino features hundreds of slot games which cover loads of different themes and come packed with a variety of bonuses.

LibraBet Casino offers a fully developed mobile casino that is available straight from your phone or tablet browser with no need to download separate apps. The mobile casino works equally well on Android and iOS devices and offers the full range of gaming and banking options.

LibraBet Casino offers players a wide selection of slot games. In fact, there are close to 1,000 different titles, and they all certainly are worth your while. Some of the popular games available at the casino includes Jimi Hendrix, Butterfly Staxx, Cash bug, Fish Catch, ChilliPop, Jack in a Pot, Banana Jones, rocket Dice and Victorious. If you like table games, there are several versions of Roulette, Baccarat, and Blackjack.

LibraBet Casino is owned and operated by Araxio Development NV, a company based in Curacao. The all casino website is fully licensed by the Curacao Gaming Authority.

LibraBet Casino takes its security system very seriously. All transactions are protected by secure 128-bit SSL encryption technology. All your personal data and financial transactions will be protected by encryption technology and online communication protocols.

LibraBet Casino follows the latest 128-but SSL encryption trends and employs a series of additional safety measures. The online casino dollar uses very efficient encryption technology like SSL encryption technology to scramble players' information and protect these precious information from hackers and identity thieves.

LibraBet Casino supports a number of payment methods that its players can choose from for their deposit and/or withdrawal transactions. The methods are Visa, Mastercard, Skrill, Neteller, Paysafecard, QIWI, Multibanco, Yandex Money, Boletoand Bank Transfer. You can choose the currency you prefer for all transactions; options include RUB, EUR, HUF, NOK and CAD.

If you have challenges or questions, you need help or assistance as regards any area of LibraBet Casino, there is a live chat function available around the clock 24/7. There is an FAQ section in the casino website where the frequent questions from players are given detailed answers. The customer support service is available 24/7 to serve all customers to their fulfilment.